Taxpayer Relief Act 2026 – The American Taxpayer Relief Act of 2012 enacted a permanent AMT fix by establishing Thus, barring legislation from Congress, the AMT will return in force in 2026, affecting 6.7 million taxpayers. . The American Taxpayer Relief Act of 2012 is a United States federal statue enacted in 2012 to address certain aspects of the so-called Fiscal Cliff, i.e. certain mandatory tax increases and budget .

Taxpayer Relief Act 2026

Source : www.taxpolicycenter.org

Estate Tax – Current Law, 2026, Biden Tax Proposal

Source : www.krostcpas.com

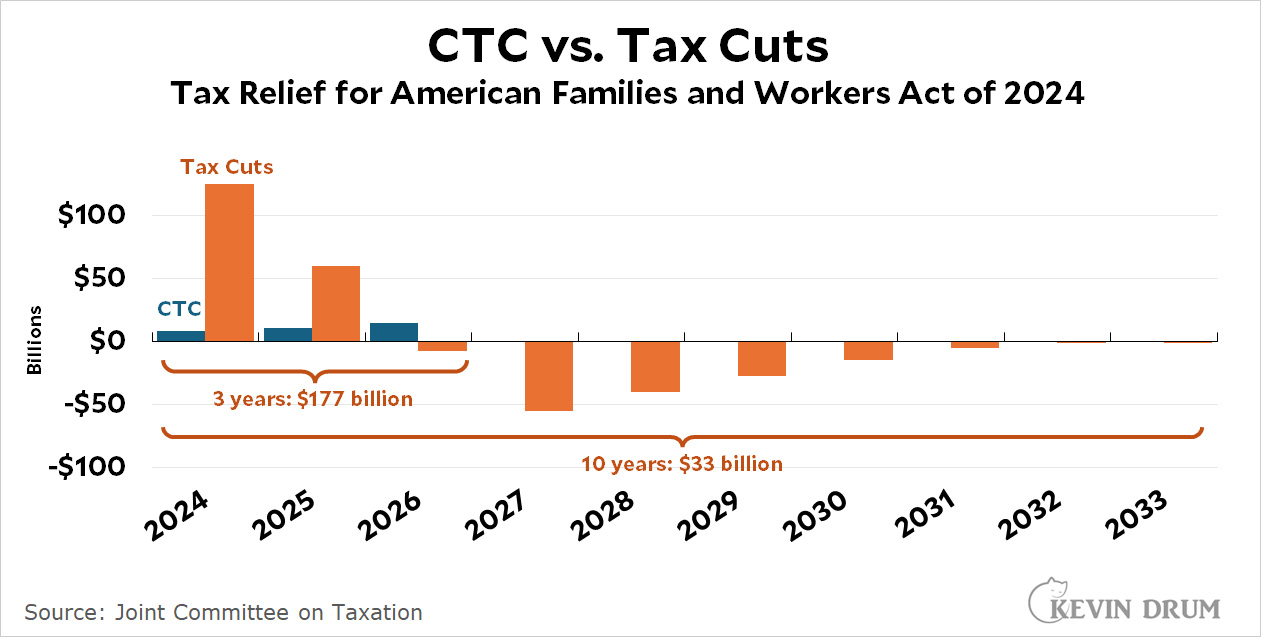

Maybe that Child Tax Credit bill isn’t so great after all – Kevin Drum

Source : jabberwocking.com

Extending Temporary Provisions of the 2017 Trump Tax Law: National

Source : itep.org

How did the Tax Cuts and Jobs Act change business taxes? | Tax

Source : www.taxpolicycenter.org

New property tax relief for N.J. seniors is now law. But will full

Source : www.nj.com

T20 0030 Number of Tax Units by Tax Bracket and Filing Status

Source : www.taxpolicycenter.org

Governor Proposes ‘Forward Looking’ $9.95 Billion Budget The

Source : wyomingtruth.org

T18 0088 Average Effective Federal Tax Rates All Tax Units, By

Source : www.taxpolicycenter.org

Taxation Finance Act 2021: 9781292406725: Amazon.com: Books

Source : www.amazon.com

Taxpayer Relief Act 2026 Working Families Tax Relief Act Provides Substantial Benefits : Calvin reports the amount of payments, which includes scholarships and grants received, equivalent to the amount of qualified tuition billed for the year and will provide to students the IRS Tax Form . Download and save the PDF to your computer Open the downloaded PDF in Acrobat Reader 10 or later A form a taxpayer can complete and submit to request relief under the taxpayer relief provisions. .