Child Tax Credit 2024 Phase Out – The 2024 tax season is starting soon, and you may be looking for all the tax credits you’re eligible for. If you have kids, you probably already know whether you’re eligible for the federal child tax . If you paid for childcare, you may also qualify for the child and dependent care credit. Depending on your circumstances, you can declare 20% to 35% of your childcare expenses. The maximum you can .

Child Tax Credit 2024 Phase Out

Source : itep.org

The American Families Plan: Too many tax credits for children

Source : www.brookings.edu

States are Boosting Economic Security with Child Tax Credits in

Source : itep.org

Here Are the 2024 Amounts for Three Family Tax Credits CPA

Source : www.cpapracticeadvisor.com

Build Your Own Child Tax Credit 2.0 | Committee for a Responsible

Source : www.crfb.org

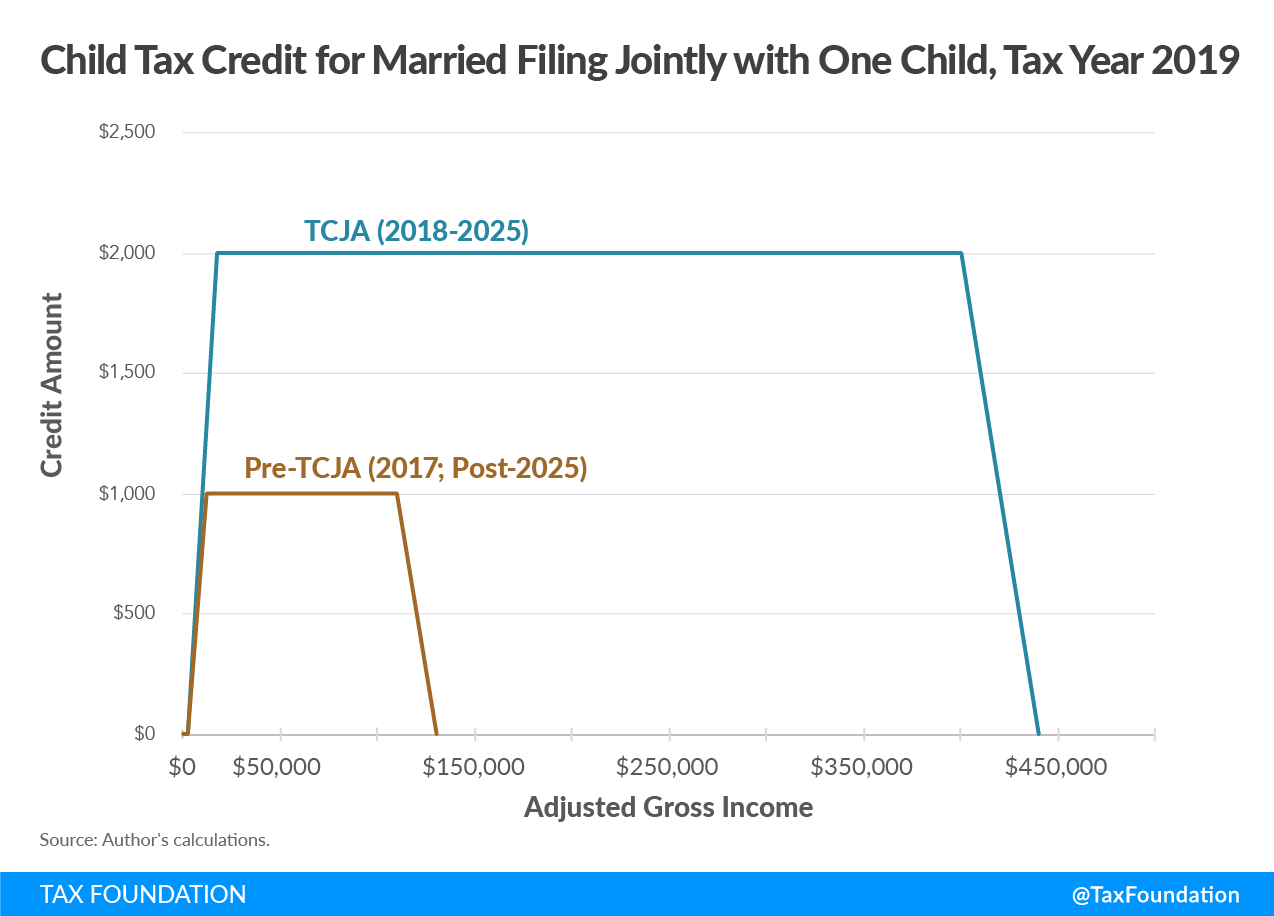

Child Tax Credit Definition | TaxEDU | Tax Foundation

Source : taxfoundation.org

2023 and 2024 Child Tax Credit: Top 7 Requirements TurboTax Tax

Source : turbotax.intuit.com

Child Tax Credit Definition | TaxEDU | Tax Foundation

Source : taxfoundation.org

States are Boosting Economic Security with Child Tax Credits in

Source : itep.org

Child Tax Credit 2023 2024: Requirements, How to Claim NerdWallet

Source : www.nerdwallet.com

Child Tax Credit 2024 Phase Out States are Boosting Economic Security with Child Tax Credits in : While parents may be shelling out thousands of dollars a month for child care costs alone, they can offset these expenses with two tax credits this season. . will start to see the value of their credit decrease and eventually phase out. In Massachusetts, taxpayers who care for a child or elderly parent can claim a tax credit that is worth $440 for each .